Published on: December 12, 2023

Created by Calculator Services Team / Fact-checked by Monjurul Kader

ATM Profit Calculator

Results:

Transactions Per Day:

Daily Surcharge Revenue:

Monthly Surcharge Revenue:

Yearly Surcharge Revenue:

An ATM profit calculator is a valuable tool for businesses considering the addition of an ATM to their services. It helps in estimating the potential earnings from ATM transactions, making it easier for owners to make informed decisions.

Retail shops often see increased customer engagement and sales with the presence of an ATM machine. By offering the convenience of cash withdrawals, these businesses can attract more foot traffic, potentially boosting overall sales. For those in the retail sector, incorporating an ATM can be a strategic move to enhance customer service and increase revenue.

The market for ATM sales and services is diverse, offering various products to meet different business needs. From selling an ATM machine to renting one for events, the options are vast. Businesses like Goldstar ATM provide comprehensive services, including sales, rentals, and maintenance. This flexibility is particularly useful for event organizers who might need an ATM rental for events, ensuring guests have easy access to cash.

For businesses considering how to rent an ATM machine, the process is straightforward and can be tailored to specific needs. Whether it’s a permanent installation in a retail shop or a temporary setup for an event, ATM services cater to a wide range of requirements.

Interested in learning more about how an ATM can benefit your business? Read our detailed article below, where we discuss various aspects of ATM services, including sales, rentals, and the potential profits you can earn through an ATM in your establishment. Our ATM profit calculator will help you estimate these earnings accurately, guiding your decision-making process.

Related Calculators:

- Yoga Studio Profit Calculator

- Corn Shrink Calculator

- Arena Footing Calculator

- Aglet Profit Calculator

- Notice Period Calculator

- 375000 Mortgage Calculator

- Pay What You Pull Raffle Calculator

ATM Profit Calculators

Definition and Purpose

An ATM profit calculator is like a crystal ball for business owners. It lets you peek into the future to see what kind of profits you might expect from installing an ATM at your location. This nifty tool takes into account various factors like customer count, transaction fees, and operational costs to give you a clear picture of potential earnings.

Key Components of the Calculator

The heart of an ATM profit calculator lies in its ability to process different variables. These include daily customer traffic, the percentage of customers likely to use the ATM, and the surcharge per transaction. By juggling these numbers, the calculator provides an estimate of daily, monthly, and yearly earnings.

Factors Influencing ATM Profits

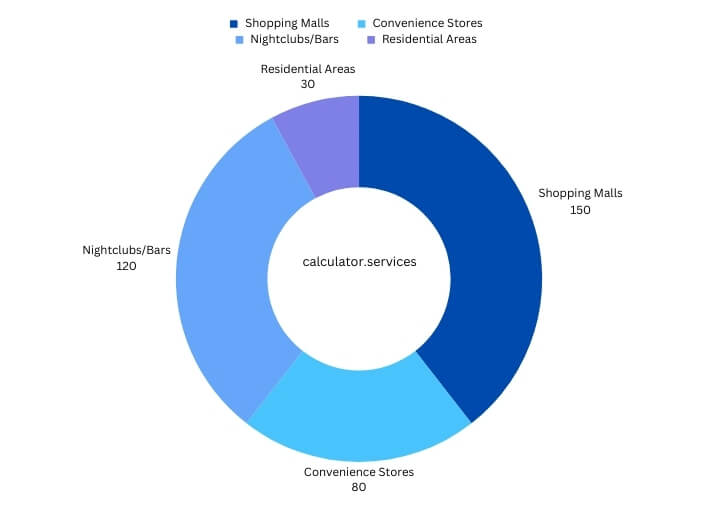

Location and Foot Traffic

Location is king in the ATM world. A machine placed in a high-traffic area like a shopping mall or a busy street corner is more likely to be used frequently. This translates to more transactions and, consequently, higher profits.

Customer Demographics

The type of customers frequenting your business also plays a crucial role. For instance, ATMs in tourist spots or entertainment districts might see more action compared to those in quiet residential areas.

Comparison of ATM Usage by Location Type

| Location Type | Average Transactions Per Day | Notes |

| Shopping Malls | 150 | High foot traffic |

| Convenience Stores | 80 | Regular, repeat customers |

| Nightclubs/Bars | 120 | High demand for cash payments |

| Residential Areas | 30 | Lower foot traffic |

Calculating Potential Earnings

Step-by-Step Guide to Using the Calculator

Using an ATM profit calculator is a breeze. You start by entering your daily customer count. Next, you estimate what percentage of them will use the ATM. Finally, you add the surcharge amount you plan to charge per transaction. Hit calculate, and voilà, you have an estimate of your potential earnings.

Variables to Consider: Transaction Fees, Operational Costs

While calculating potential profits, don’t forget to factor in the transaction fees charged by your ATM provider and the operational costs like maintenance and cash replenishment. These can nibble away at your profits if not accounted for.

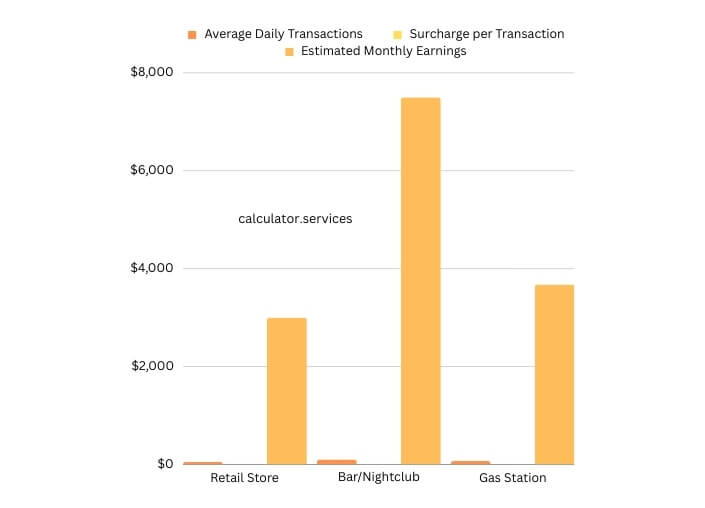

Real-World Examples of ATM Profits

Case Study: ATM in a Retail Store

Imagine a retail store with a steady stream of customers. By placing an ATM, the store not only provides a valuable service but also earns extra income through surcharge fees. It’s a win-win!

Estimated Monthly Earnings from Different Business Types

| Business Type | Average Daily Transactions | Surcharge per Transaction | Estimated Monthly Earnings |

| Retail Store | 50 | $2.00 | $3,000 |

| Bar/Nightclub | 100 | $2.50 | $7,500 |

| Gas Station | 70 | $1.75 | $3,675 |

Optimizing ATM Placement for Maximum Profit

Best Practices for ATM Placement

The right spot can make a huge difference. Place your ATM where it’s easily visible and accessible. Ensure it’s well-lit and secure, encouraging more people to use it.

Tips for Increasing ATM Usage and Revenue

Promotions like cashback offers or discounts for ATM users can boost usage. Regular maintenance ensures your machine is always up and running, ready to dispense cash and profits.

To wrap it up, an ATM profit calculator is a handy tool for any business considering adding an ATM. It helps you estimate potential earnings and make informed decisions about placement and fees. Remember, the right location and a good understanding of your customer base are key to maximizing your ATM’s profit-making potential. So, why not give it a try and see how much extra income your business could be making?