Published on: September 23, 2023

Created by Calculator Services Team / Fact-checked by Monjurul Kader

40 credits of work refer to the minimum requirement set by the Social Security Administration for individuals to qualify for retirement benefits. In essence, it represents 10 years of work, with each year contributing up to 4 credits.

In the realm of Social Security, credits are the building blocks. They are earned through employment, with a certain amount of earnings equating to one credit. Typically, an individual can earn up to 4 credits per year. To determine how many credits you’ve accumulated, you can check your Social Security statement online. This will provide a clear picture of your earned credits and potential benefits.

The minimum benefit one can receive with 40 credits varies based on several factors, including age and earnings history. If you’re curious about the exact amount, tools are available online to help you calculate your potential Social Security benefits. On the flip side, if you don’t accumulate the required 40 credits, you won’t be eligible for retirement benefits. Yet, there are other types of Social Security benefits you might qualify for, such as disability or survivor benefits.

For those who’ve worked for a decade, the minimum Social Security benefit is determined by the average indexed monthly earnings during the 35 years in which you earned the most. If you’re wondering about purchasing Social Security credits, it’s not an option. Credits can only be earned through work.

For a more in-depth look at this topic, we invite you to read the detailed article below.

Grasping the Essence of 40 Work Credits in Social Security

The Basics of Social Security Credits

Definition and Importance of Work Credits

Ever wonder why everyone keeps talking about Social Security credits? Think of them as golden tickets. Each ticket gets you closer to the grand prize: retirement benefits. The more you have, the closer you are to claiming that prize.

How Credits Relate to Benefits

It’s simple math. The number of credits you’ve got in your pocket directly impacts the benefits you’ll receive. It’s not just about quantity, though. The quality, or the amount of your earnings, also plays a role in the equation.

Earning Social Security Credits

Criteria for Earning a Credit

Earning a credit isn’t like winning a lottery. It’s based on your work and earnings. For every specific amount you earn, you get a credit. And while the amount needed for a credit might change yearly, the concept remains consistent.

Maximum Credits per Year

Picture this: You’re playing a game where you can only score four points each year. That’s how credits work. No matter how much you earn, you can only bag a maximum of four credits annually.

Visualizing Credit Accumulation

Yearly Breakdown of Earnings and Corresponding Credits

| Year | Earnings | Credits Earned |

|---|---|---|

| 2018 | $5,400 | 4 |

| 2019 | $5,600 | 4 |

| 2020 | $5,800 | 4 |

| 2021 | $6,200 | 4 |

| 2022 | $6,500 | 4 |

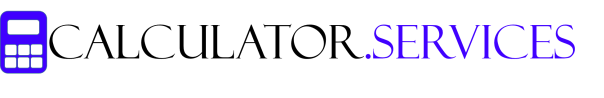

Chart: Average Number of Credits Earned by Age Group

The Significance of the 40-Credit Threshold

Eligibility for Retirement Benefits

Reaching the 40-credit mark is like crossing the finish line in a marathon. It means you’ve met the basic requirement to qualify for retirement benefits. It’s a milestone worth celebrating!

Implications for Other Social Security Benefits

Beyond retirement, these credits can be your ticket to other benefits. Disability or survivor benefits, for instance, might be within reach even if you haven’t hit the big 40.

Tools to Track Your Credits

Accessing Your Social Security Statement Online

Imagine having a ledger that keeps track of all your golden tickets. That’s your online Social Security statement. It’s a treasure trove of information, showing you how many credits you’ve earned and what benefits you can expect.

Estimating Future Credits

Got plans for the future? By looking at your current earnings and projecting forward, you can get a ballpark figure of how many credits you’ll have down the road.

What If You Fall Short?

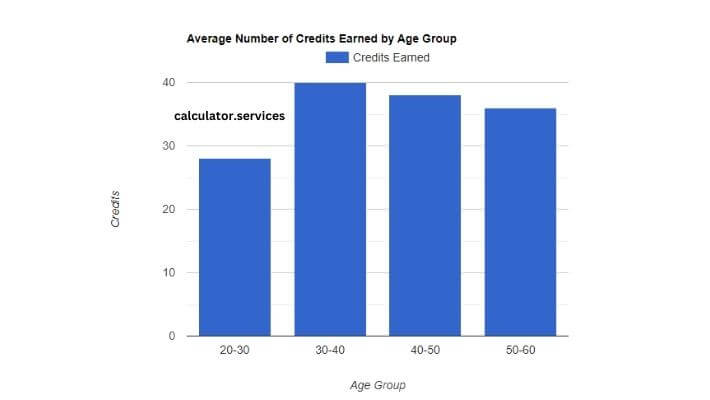

Chart: Distribution of People with Less Than 40 Credits

Alternatives and Other Benefit Types

Falling short of 40 credits isn’t the end of the world. There are other paths to tread. For instance, you might still be eligible for certain benefits based on your unique circumstances.

Calculating Your Benefits

Factors Influencing Benefit Amount

Your benefit isn’t just a random number. It’s a reflection of your earnings over the years, especially during your highest earning 35 years. So, the more you’ve earned, the bigger the prize.

Calculator: Estimating Your Potential Social Security Benefits

Myths and Misconceptions

Can You Buy Social Security Credits?

Let’s bust this myth right now. No, you can’t buy your way to more credits. They’re earned, not purchased. It’s a common misconception, but now you know better!

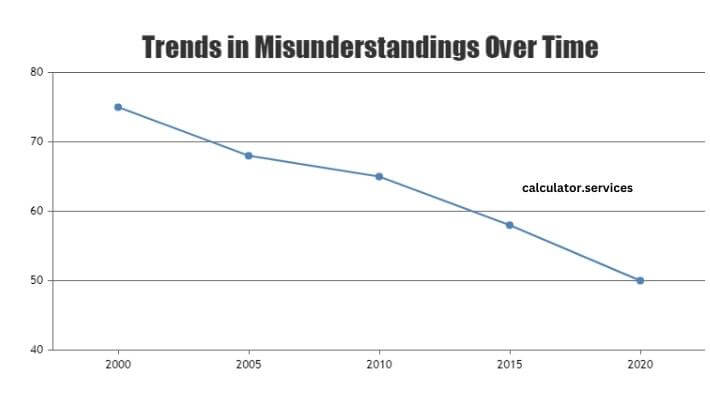

Chart: Trends in Misunderstandings Over Time

Frequently Asked Questions (FAQs)

What Are Social Security Work Credits?

Social Security work credits are the units you earn through employment in the U.S. These credits determine your eligibility for Social Security benefits. As you work and pay Social Security taxes, you earn credits, with a maximum of four credits possible each year.

How Are the 40 Credits for Social Security Achieved?

Achieving 40 credits is equivalent to 10 years of work, given that you can earn up to 4 credits per year. Each year, the amount of earnings required for a credit might change, but regardless of earnings, you can’t earn more than four credits annually.

Why Are 40 Credits Significant in Social Security?

The 40-credit mark is the basic requirement set by the Social Security Administration for individuals to qualify for retirement benefits. It’s like a threshold. Once you cross it, you become eligible for retirement benefits based on your earnings record.

What Happens If I Don’t Reach 40 Credits?

If you don’t accumulate the necessary 40 credits, you won’t qualify for retirement benefits. But don’t lose hope. There are other types of Social Security benefits, like disability or survivor benefits, that you might be eligible for based on different criteria.

Can I Earn More Than 4 Credits in a Year?

No, the maximum number of credits you can earn in a single year is four, regardless of how high your earnings might be. Think of it as a cap that ensures everyone has an equal yearly earning potential in terms of credits.

Is There a Way to Buy Additional Social Security Credits?

No, Social Security credits cannot be purchased. They can only be earned through work and the subsequent Social Security taxes paid on those earnings. It’s a system based on genuine work contributions over time.

How Can I Check My Accumulated Credits?

You can check the number of credits you’ve earned by accessing your Social Security statement online. This statement provides a detailed record of your earnings, the credits you’ve accumulated, and an estimate of the benefits you can expect to receive in the future.

Navigating the world of Social Security credits can feel like a maze. But with the right knowledge, you can chart a clear path. Remember, it’s all about the golden tickets. The more you earn, the closer you get to the grand prize. And even if you don’t hit the magic number, there are still paths worth exploring. So, keep earning, keep learning, and keep moving forward!

See More Useful Calculators:

- Electric HP vs Gas HP Calculator: Power Comparisons Made Simple

- Infusion Molar Ratio Calculator

- Baking Soda Pool pH Calculator: The Ultimate Guide

- Find Your Perfect Corset Fit with Our Corset Size Calculator

- Top 6 Best Books on Multivariable Calculus (2023)

- Effortlessly Converting Fahrenheit to Celsius